When you hear the name owns “Sun Life Insurance,” you might envision the radiant promise of financial security under a metaphorical sun. But have you ever wondered who stands behind this venerable institution, casting that reassuring glow? In this article, we delve deep into the ownership, history, and governance of Sun Life Insurance, uncovering the key players and pivotal moments that have shaped its legacy. With a sprinkle of humor and a wealth of information, we’ll illuminate the story behind one of the world’s leading financial services companies. Seven Corners Travel Insurance: Comprehensive Protection for Your Adventures 2024

Table of Contents

- What Are Airdrops? A Complete Guide to Cryptocurrency Airdrops (October & November 2024)

- Pakistan vs. England: Day 2 Recap – Dominance from Pakistan, Resilience from England.

- 10 Proven Ways to Earn Money Online Fast (Even Without Experience)

- Finding the Best Auto Insurance: Your Complete Guide 2024

- The Ultimate Guide to Home and Auto Insurance: A Comprehensive and Humorous Look 2024

The Origins of Sun Life Insurance

Before we dive into the present-day ownership of Sun Life Insurance, it’s essential to journey back to its roots. Sun Life Financial Inc., the parent company of Sun Life Insurance, was founded in 1865 in Montreal, Quebec, by Matthew Hamilton Gault. Gault, an Irish immigrant, had a vision of providing financial security to Canadians. Over the decades, Sun Life expanded its horizons beyond Canada, establishing a global presence.

The Evolution of Sun Life Insurance

From its humble beginnings, Sun Life Insurance has grown into a multinational financial services giant. The company offers a wide array of products, including life insurance, health insurance, investment management, and retirement solutions. This expansion has been driven by strategic acquisitions, innovative product development, and a commitment to customer service.

Who Owns Sun Life Insurance?

The question of who owns Sun Life Insurance can be approached from several angles, considering its structure as a publicly traded company and its governance.

1. Public Ownership

Sun Life Financial Inc. is a publicly traded company listed on the Toronto (TSX: SLF), New York (NYSE: SLF), and Philippine (PSE: SLF) stock exchanges. This means that Sun Life is owned by its shareholders, which include individual and institutional investors from around the world. These shareholders have a stake in the company’s success and growth, receiving dividends and benefiting from capital appreciation.

2. Major Shareholders

While the company has thousands of shareholders, certain institutional investors hold significant shares. According to recent filings, major institutional shareholders include The Vanguard Group, BlackRock, and Fidelity Investments. These financial powerhouses invest in Sun Life on behalf of their clients, reflecting confidence in the company’s performance and prospects.

3. Board of Directors and Executive Leadership

The governance of Sun Life Insurance is overseen by its Board of Directors, which includes seasoned professionals from various industries. The board is responsible for setting the company’s strategic direction and ensuring accountability. Additionally, the executive leadership team, led by the CEO, manages the day-to-day operations and long-term planning. You can find detailed information about Sun Life’s leadership on their official website.

The Role of Sun Life Financial Inc.

Sun Life Financial Inc. operates through several subsidiaries, each focusing on different aspects of the financial services industry. These subsidiaries include Sun Life Assurance Company of Canada, Sun Life Global Investments, and Sun Life Asset Management. This diversified approach allows Sun Life to cater to various customer needs, from individual life insurance policies to complex investment portfolios for institutional clients.

Sun Life’s Global Footprint

One of the remarkable aspects of Sun Life Insurance is its extensive global footprint. The company operates in numerous countries, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, and Malaysia. This international presence underscores Sun Life’s commitment to providing financial security to individuals and businesses worldwide.

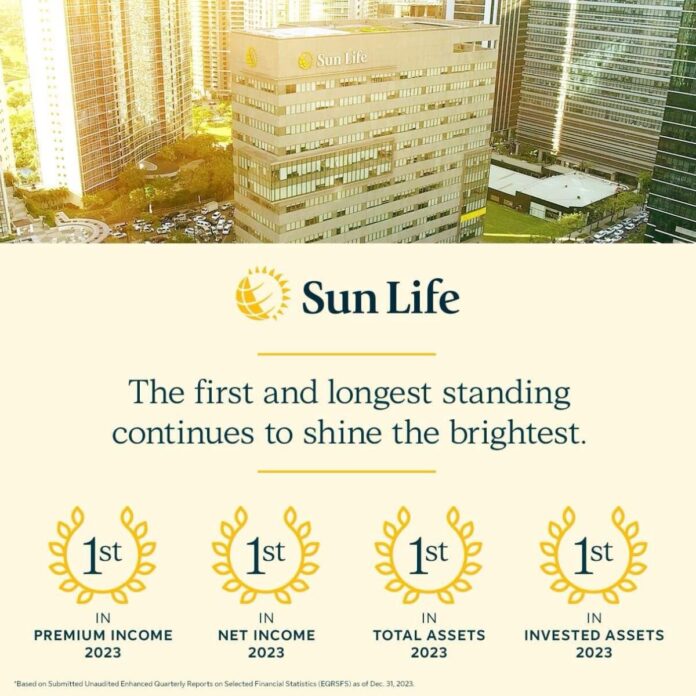

Sun Life’s Financial Performance

To understand the strength and stability of Sun Life Insurance, it’s essential to look at its financial performance. In recent years, Sun Life has reported robust financial results, driven by growth in its core business segments and strategic acquisitions. The company’s revenue and net income have shown consistent growth, reflecting its ability to adapt to changing market conditions and meet customer needs.

1. Revenue Growth

Sun Life’s revenue comes from a mix of insurance premiums, investment income, and fees from asset management services. This diversified revenue stream helps the company mitigate risks and maintain financial stability even during economic downturns.

2. Profitability

The company’s profitability is a testament to its efficient operations and prudent risk management. Sun Life’s net income has steadily increased, providing a solid return on investment for shareholders.

3. Capital Strength

Sun Life maintains a strong capital position, ensuring it can meet policyholder obligations and invest in future growth. This financial strength is recognized by major rating agencies, which consistently rate Sun Life among the top insurers in terms of creditworthiness.

Sun Life’s Commitment to Sustainability

In today’s world, corporate responsibility and sustainability are more important than ever. Sun Life Insurance is committed to environmental, social, and governance (ESG) principles, integrating them into its business strategy. This commitment is evident in various initiatives, such as sustainable investing, reducing carbon footprints, and supporting community development.

The Human Side of Sun Life

Beyond the numbers and financial performance, Sun Life Insurance is about people—employees, clients, and communities. The company prides itself on a culture of inclusion, diversity, and innovation. Sun Life’s workforce is composed of talented individuals who are dedicated to helping clients achieve lifetime financial security and live healthier lives.

Humorous Anecdotes from Sun Life’s History

Now, let’s lighten things up with a few humorous anecdotes from Sun Life’s long history:

- The Case of the Missing Luggage: In the early days, a Sun Life salesman lost his sample case full of policy forms and promotional materials. The case was eventually found—being used as a prop in a local theater production!

- Policyholder Perks: Back in the 1920s, Sun Life offered a unique perk to policyholders: free haircuts. The company had an in-house barber to ensure clients looked sharp when signing their policies.

- Technology Troubles: In the 1980s, Sun Life introduced its first computerized underwriting system. The initial version was so complex that it required a week-long training session—and a lot of coffee—for the staff to learn how to use it.

The Future of Sun Life Insurance

As Sun Life Insurance continues to evolve, it remains focused on innovation and customer-centricity. The company is investing in digital transformation, enhancing its online platforms, and leveraging data analytics to provide personalized services. These efforts aim to make financial security more accessible and convenient for clients worldwide.

Conclusion

Sun Life Insurance, under the umbrella of Sun Life Financial Inc., is a global leader in the financial services industry. Its ownership structure, comprising public shareholders and major institutional investors, reflects a broad base of support and confidence in its future. With a rich history, strong financial performance, and a commitment to sustainability, Sun Life is well-positioned to continue providing comprehensive financial solutions for generations to come.

Whether you’re considering a life insurance policy, planning for retirement, or looking for investment opportunities, Sun Life Insurance offers a range of products to meet your needs. By choosing Sun Life, you’re not just getting an insurance policy—you’re partnering with a company that values your financial security and well-being.

For more information about Sun Life Insurance, visit their official website and explore the various products and services they offer.

Sources

- Sun Life Financial Inc.

- Sun Life Leadership

- Yahoo Finance – Sun Life Financial

- Morningstar – Sun Life Financial

- Investopedia – Sun Life Financial

By exploring the ownership, history, and future prospects of Sun Life Insurance, this article aims to provide a comprehensive overview that is both informative and engaging.